In the ever-evolving landscape of financial markets, CFD brokers in the UK are increasingly turning to API trading platforms to gain a competitive edge and enhance their trading capabilities. These platforms offer a plethora of advantages, empowering brokers with seamless integration, advanced trading functionalities, and enhanced market access. But what exactly are the advantages of utilizing an Best Api Trading Platform for CFD brokers in the UK? Let’s delve into the key benefits.

Enhanced Flexibility and Customization

API trading platforms provide CFD brokers in the UK with unparalleled flexibility and customization options. By leveraging APIs (Application Programming Interfaces), brokers can tailor their trading strategies, algorithms, and risk management parameters to suit their specific needs and preferences. This level of customization empowers brokers to adapt swiftly to changing market conditions and capitalize on emerging opportunities effectively.

Real-Time Market Data and Execution Speed

One of the primary advantages of API trading platforms is their ability to deliver real-time market data and lightning-fast execution speeds. Best Cfd Brokers Uk can access live pricing, market depth, and order book information instantaneously, enabling them to make informed trading decisions in real-time. With sub-millisecond order execution, API platforms ensure that brokers capitalize on price movements swiftly, thereby maximizing trading efficiency and profitability.

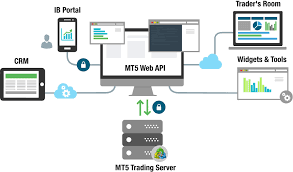

Seamless Integration with Third-Party Systems

API trading platforms offer seamless integration with a wide range of third-party systems, including trading algorithms, risk management tools, and analytics software. CFD brokers in the UK can effortlessly connect their preferred tools and services to the platform, creating a cohesive trading ecosystem that enhances operational efficiency and decision-making capabilities. Whether it’s integrating proprietary trading algorithms or connecting with external liquidity providers, API platforms facilitate seamless connectivity, empowering brokers to optimize their trading workflows.

Access to Advanced Trading Functionalities

Another significant advantage of API trading platforms is the access to advanced trading functionalities that enhance trading precision and sophistication. From algorithmic trading strategies to automated order routing and execution, these platforms offer a comprehensive suite of tools designed to meet the diverse needs of CFD brokers in the UK. Whether executing high-frequency trades or implementing complex trading algorithms, brokers can leverage advanced functionalities to gain a competitive edge in the market.

Robust Risk Management Controls

Risk management is paramount in the world of CFD trading, and API trading platforms offer robust risk management controls to help brokers mitigate potential risks effectively. These platforms allow brokers to set predefined risk parameters, monitor exposure in real-time, and implement automated risk management protocols. By leveraging advanced risk management tools and controls, brokers can minimize the impact of adverse market movements and protect their capital more effectively.

Scalability and Reliability

API trading platforms are designed to scale with the growing needs of CFD brokers in the UK, offering a reliable and robust infrastructure that can support high-volume trading activities. Whether handling a few hundred trades or processing thousands of orders per second, these platforms deliver unparalleled scalability and reliability, ensuring uninterrupted access to the market at all times. With built-in redundancy and failover mechanisms, API platforms offer the resilience and stability required to thrive in today’s fast-paced trading environment.

Lower Costs and Increased Efficiency

Finally, API trading platforms offer CFD brokers in the UK the opportunity to lower costs and increase operational efficiency. By automating various aspects of the trading process, such as order execution, reconciliation, and reporting, these platforms enable brokers to streamline their operations and reduce manual intervention. This not only leads to cost savings but also frees up valuable time and resources that can be allocated to more strategic initiatives, ultimately driving greater efficiency and profitability.

In conclusion, API trading platforms offer a myriad of advantages for CFD brokers in the UK, ranging from enhanced flexibility and customization to real-time market data, advanced trading functionalities, and robust risk management controls. By leveraging these platforms, brokers can gain a competitive edge in the market, optimize their trading workflows, and achieve greater success in today’s dynamic financial landscape.