Buy PS4 Controller Wireless Bluetooth Gamepad for Sony Playstation 4 with USB Cable Compatible with Windows PC & Android iOS【Upgraded Version】(Midnight Blue) Online in Nicaragua. B08SLXBK7W

![Apple MFi Certified] Bluetooth Gamepad, Megadream Wireless IOS Gaming Controller Joystick Joypad with Phone Clamp | Walmart Canada Apple MFi Certified] Bluetooth Gamepad, Megadream Wireless IOS Gaming Controller Joystick Joypad with Phone Clamp | Walmart Canada](https://i5.walmartimages.com/asr/01ee57dc-7f99-4737-9c84-f9a2682cd851.624792c47908698e97dfa407a0999a8f.jpeg?odnHeight=450&odnWidth=450&odnBg=ffffff)

Apple MFi Certified] Bluetooth Gamepad, Megadream Wireless IOS Gaming Controller Joystick Joypad with Phone Clamp | Walmart Canada

Laptop Murah XBOX 360 CONTROLLER Wired USB Joystick Support PC Laptop(Ready Stock)(Local Seller)(Fast Delivery) | Shopee Malaysia

MOCUTE 060 Gamepad Bluetooth Dual Mode Compatible With 2.0 5.2 Windows Ergonomic Design PUBG Gamepad Controller For Ios Android|Gamepads| - AliExpress

![Apple MFi Certified] Bluetooth Gamepad, Megadream Wireless IOS Gaming Controller Joystick Joypad with Phone Clamp | Walmart Canada Apple MFi Certified] Bluetooth Gamepad, Megadream Wireless IOS Gaming Controller Joystick Joypad with Phone Clamp | Walmart Canada](https://i5.walmartimages.com/asr/be449862-60a3-496d-988e-2aa2b32dae0e.68ed523506c0ca8ec3ca06dd7132992a.jpeg?odnHeight=450&odnWidth=450&odnBg=ffffff)

Apple MFi Certified] Bluetooth Gamepad, Megadream Wireless IOS Gaming Controller Joystick Joypad with Phone Clamp | Walmart Canada

Telescopic Bluetooth compatible Game Controller Wireless Gamepad Trigger Joystick For PUBG For IOS 13.4 Below Android Phone|Gamepads| - AliExpress

Razer Kishi for Android (Xbox) Gaming Controller: Cloud Gaming Ready Compatible with Most USB-C Android Phones Black RZ06-02900200-R3U1 - Best Buy

![Star Wars: Knights of the Old Republic [Gamepad support #2] - YouTube Star Wars: Knights of the Old Republic [Gamepad support #2] - YouTube](https://i.ytimg.com/vi/qI2ztc7Ug_0/maxresdefault.jpg)

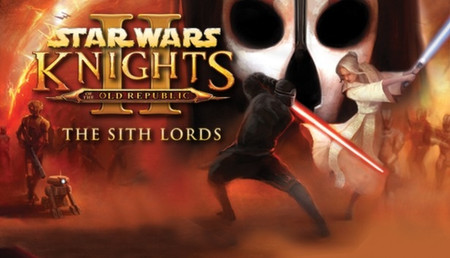

![Knights of the Old Republic 2: TSL [GAMEPAD SUPPORT] - YouTube Knights of the Old Republic 2: TSL [GAMEPAD SUPPORT] - YouTube](https://i.ytimg.com/vi/SblDUSKOMPU/maxresdefault.jpg)