IMPRESSIONS SUNSET Makeup Mirror with LED Bulbs | Round Shape Vanity Dressing Mirror with Standing Base & Power Outlet - Walmart.com

IMPRESSIONS Touch Pro Makeup Mirror with LED Light and Bluetooth Speaker, Rectangle Vanity Mirror with USB Charging Port and Standing Base - Walmart.com

Impressions Vanity Hollywood Reflection Plus Vanity Mirror with Clear LED Bulbs | Ashley Furniture HomeStore

Impressions Vanity Mirror with Lights Hollywood Aurora Makeup Mirror with 15 Frosted LED Lights Dimmer Switch and Standing or Wall Mounting - Walmart.com

Amazon.com - Impressions Vanity Mirror with Lights and Dimmer Switch, Starlight Pro Wireless Bluetooth Makeup Mirror with 15 LED Lights and Standing or Wall Mounting (White) -

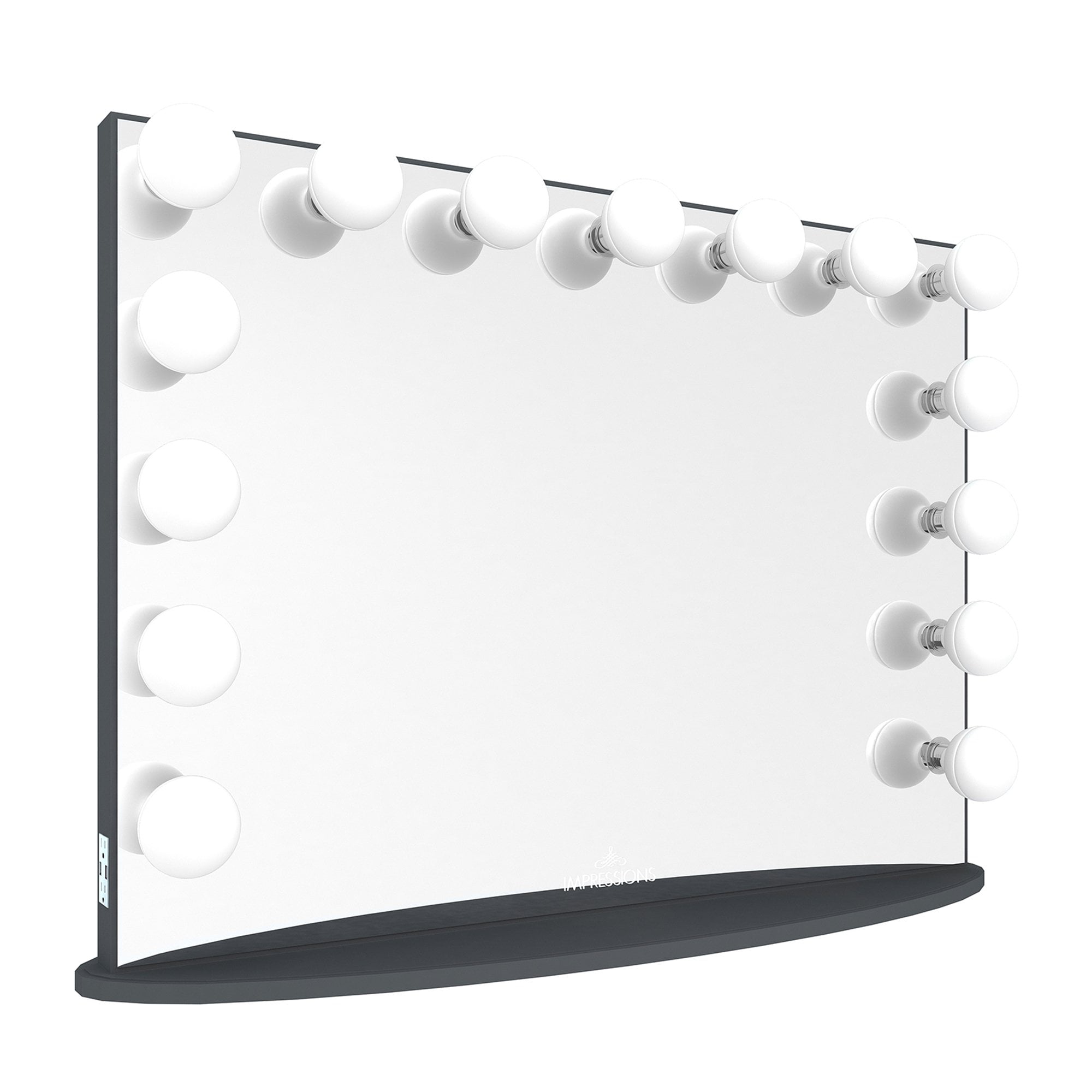

Impressions Hollywood Glow Pro Vanity Mirror with Lights and USB Ports, Tabletop or Wallmount Lighted Makeup Mirror with 15 LED Bulbs and Dimmer Switch for Bedroom Dressing Room - Walmart.com

Amazon.com - Impressions Vanity Hollywood Tri Tone Makeup Mirror with 6 LED Bulbs, Vanity Dressing Mirror with 360 Degree Swivel and Soft Touch Sensor Dimmer Switch (Black) -

Amazon.com - Impressions Touch Highlight Makeup Mirror with LED Light, Dressing Tabletop Vanity Mirror with Double Power System (Rose Gold) -